If you’ve worked in the nonprofit sector for some time, you’ve probably realized that effective financial management is essential to your organization’s short- and long-term success. Not only does understanding your revenue and expenses help you fund your current initiatives, no matter what circumstances may arise, but it also allows you to plan for growth and create lasting impact in your community.

One key piece of the nonprofit financial management puzzle is adopting a fund accounting system. While fund accounting might just look like a method for managing your nonprofit’s fiscal data or one more requirement your organization has to follow, it’s actually a critical tool for furthering your mission.

In this guide, we’ll review the basics of fund accounting and some tips for ensuring this system promotes financial transparency at your nonprofit while also helping you comply with various regulations. Let’s get started!

What is fund accounting?

CFO Leverage’s guide to fund accounting defines this term as “a method of managing finances…[that] tracks which funds are designated for various programs and operations and how much money is allocated to each activity.” It helps your nonprofit lean into the accountability side of accounting, since your main goal in financial management should be to fulfill your promises to donors and funders to use the resources they’ve provided to make a difference, not a profit.

The “funds” in fund accounting can be broken down into three categories as follows:

- Unrestricted funds don’t have any donor- or funder-imposed designations attached to them, so you can put them toward any of your nonprofit’s expenses. Most small to mid-sized individual and corporate gifts, as well as earned income from sources like membership dues and merchandise sales, are unrestricted.

- Permanently restricted funds usually take the form of endowments, which Infinite Giving defines as “dedicated source[s] of long-term funding made up of donations that support a philanthropic organization’s mission and work.” Your nonprofit can’t spend these donations directly—instead, you’ll invest them and use the interest to fund a donor-designated initiative in perpetuity.

- Temporarily restricted funds include most planned and major gifts, grants, and corporate sponsorships. These gifts are initially designated for a specific purpose, but once that purpose is fulfilled, any leftover funding can be released from restriction. For example, if a corporate sponsor contributes $10,000 for an event and you only need to spend $9,500 of it, you can reallocate the remaining $500 as long as the sponsor agrees to it.

Nearly all tax-exempt organizations use fund accounting, including:

- Traditional 501(c)(3) nonprofits

- Public, private, and family foundations

- Federal, state, and local governments

- Professional and trade associations

- Public and private K-12 schools

- Colleges and universities

- Churches and other faith-based organizations

- Hospitals and other healthcare organizations

While some nuances of fund accounting may vary between organizations, the core principles of accountability and restricted vs. unrestricted funding are the same across the board.

Benefits of Fund Accounting

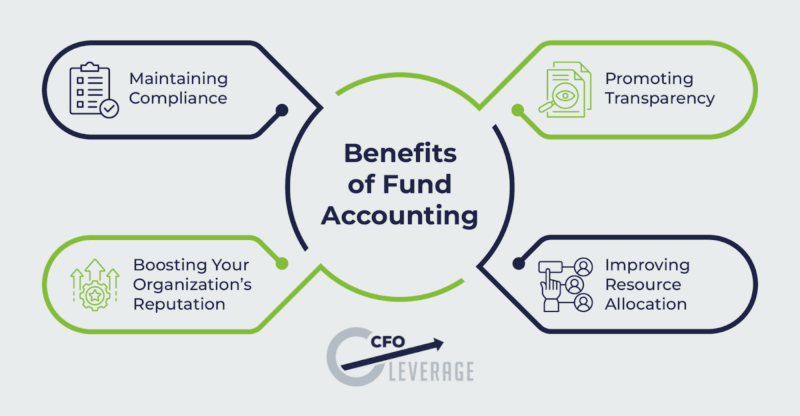

Implementing a fund accounting system at your nonprofit can provide you with many benefits, such as:

why fund accounting matters_supplementary [alt text: A mind map of four benefits of fund accounting, which are listed below.]

- Maintaining compliance with accounting standards and regulations for nonprofits. These include both government reporting requirements that affect your annual tax returns and guidelines set by independent organizations like the Financial Accounting Standards Board (FASB).

- Promoting transparency around how your organization uses contributions, especially restricted ones. Open, data-backed communication is critical for building trust with your nonprofit’s most impactful supporters, whether they’re individuals, companies, or foundations.

- Boosting your organization’s reputation as a nonprofit that cares about its supporters and delivers on its promises. To maximize this benefit, publicize key financial reports and data from your fund accounting system—for example, you may link to past Form 990s on your website and create financial charts and graphs for your annual report.

- Improving resource allocation by helping you finance all of your nonprofit’s programs and operations without accidentally misappropriating restricted funds. Donor- and funder-imposed designations are legally binding, meaning your organization can face penalties and even lawsuits if you don’t abide by funding restrictions.

Fund accounting helps you ensure your nonprofit always has the resources it needs to serve the community and drive its mission forward, ultimately bolstering its long-term health and sustainability.

Fund Accounting Tips

Now that you understand the basics of fund accounting, you might be wondering how to apply them at your nonprofit, especially if your role doesn’t fully revolve around finance. Here are a few general tips to help your team make the most of its fund accounting system:

- Pursue restricted contributions strategically. Whenever you’re trying to bring in a type of revenue that could be restricted, ensure it aligns with your organization’s goals and funding priorities. If you’re applying for a grant, you should always be able to use it for a current or upcoming program based on funder guidelines. If you’re soliciting major gifts, encourage the donor to designate their gift for one of your biggest areas of need.

- Allocate revenue with designations first when budgeting. It’s typically easiest to create your annual operating budget by first laying out your expenses for the year and then figuring out how you’ll cover them. Note how much of your funding is restricted and where those funds need to go before you allocate any other revenue to prevent misappropriation at any point in the process.

- Separate out restricted funds in internal reports. Financial statements like balance sheets, statements of activities, and cash flow reports are essential resources for internal decision-making and referencing while you complete external reports. Recording restricted funds separately on your statements makes it easier to ensure accuracy in both of those areas.

- Leverage the financial resources available to you. If your organization doesn’t use dedicated accounting software, consider investing in a platform that’s either nonprofit-specific or customizable for nonprofits to facilitate fund accounting. Also, if you don’t have a bookkeeper, accountant, or chief financial officer (CFO) on staff, you may want to work with outsourced nonprofit financial professionals to help you maintain fund accounting best practices.

Even if you leverage outsourced financial services or hire an internal finance team, everyone at your organization should have a general understanding of fund accounting principles and practices so they know how to handle funding in their day-to-day work and can make the best possible decisions for your mission.

Fund accounting is critical for compliance and risk prevention at your nonprofit, but it also helps your organization remain accountable, transparent, and effective at serving its community. Use the guidance and strategies above to get started, and remember that you can always reach out for professional advice or assistance if you need it.

Sam Coates, Co-Founder, CFO Leverage

Launching his first company at age 21, Sam quickly grasped the critical importance of understanding finances from a business owner’s viewpoint. His journey as an entrepreneur exposed him to various industry challenges, fostering a deep appreciation for innovative, adaptable solutions that directly address client needs. With an entrepreneurial spirit and a customer-centric approach, he continues to create practical solutions that perfectly align with clients’ unique needs.